Franco-Nevada is the leading gold-focused royalty and streaming company globally with the largest and most diversified

portfolio of royalties and streams by

commodity, geography, revenue type and stage of project.

Franco-Nevada’s shares are listed on the Toronto and New York stock exchanges under the symbol FNV. An investment in

Franco-Nevada’s shares is expected to

provide investors with yield and exposure to commodity price and exploration optionality while limiting exposure to

cost inflation and other operating

risks.

Our aspiration is to make Franco-Nevada the “go to” gold stock for the generalist investor. We believe that our

emphasis on minimizing risk, paying

dividends and maintaining a strong balance sheet along with high environmental, social and governance standards is

attractive to generalist investors.

The Gold Investment that Works

Franco-Nevada is committed to being the gold investment that works; for our shareholders, our operating partners and

our communities.

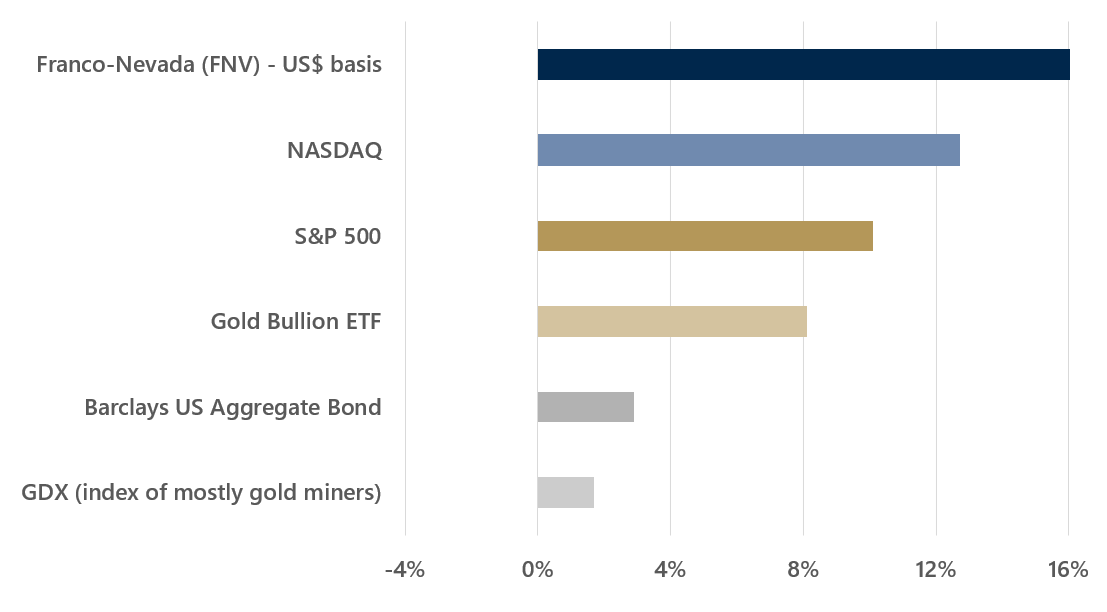

- Compounded annual total returns to April 30, 2025. Source: TD Securities; Bloomberg

Our Performance

Since our initial public offering over 18 years ago, our share price has outperformed the gold price and all relevant

gold equity benchmarks.

Compounded Average Annual Total Returns since inception1, 2, 3

- FNV Inception – December 20, 2007

- Compounded annual total returns to April 30, 2025

- Source: TD Securities; Bloomberg

Our Track Record

We have grown our revenues substantially while keeping G&A low, growing cash flow and earnings.

-

Starting in Q4 2021, revenue from Franco-Nevada’s Energy assets are included in the calculation of Gold Equivalent

Ounces (“GEOs”). GEOs for comparative periods have been recalculated to conform with the current presentation.

GEOs

include Franco-Nevada’s attributable share of production from our Mining and Energy assets, after applicable

recovery

and payability factors. GEOs are estimated on a gross basis for NSR royalties and, in the case of stream ounces,

before

the payment of the per ounce contractual price paid by the Company. For NPI royalties, GEOs are calculated taking

into

account the NPI economics. Silver, platinum, palladium, iron ore, oil, gas and other commodities are converted to

GEOs

by dividing associated revenue, which includes settlement adjustments, by the relevant gold price. The price used

in the

computation of GEOs earned from a particular asset varies depending on the royalty or stream agreement, which may

make

reference to the market price realized by the operator, or the average price for the month, quarter, or year in

which

the commodity was produced or sold.

- Adjusted Net Income, Adjusted Net Income per share, Adjusted EBITDA, and Adjusted EBITDA per share are non-GAAP

financial measures with no standardized meaning under International Financial Reporting Standards (“IFRS

Accounting

Standards”) and might not be comparable to similar financial measures disclosed by other issuers. Refer to the

“Non-GAAP

Financial Measures” section starting on page 128 of the Asset

Handbook.

-

Fiscal years 2010 through 2024 were prepared in accordance with IFRS Accounting Standards. Fiscal years 2008 and

2009

were prepared in accordance with Canadian GAAP. Comparative information has been adjusted to conform to current

presentation.

- The Company defines Working Capital as current assets less current liabilities.

- As at December 31.

Our Dividend Policy

Our dividend policy is not tied to any financial metric or the gold price. Our objective is a sustainable and

progressive dividend regardless of the gold price outlook and we have increased our dividend each of the last 18

years.

- Quarterly dividend starting Q1 2025

- Includes DRIP

- As of March 31, 2025

- Indicative dividend payment in 2025